If you’re a homeowner, headlines like “a sharp correction is coming” and “the bubble is about to burst” send shivers up your spine, but they are music to the ears of anyone looking to break into the market.

The extreme downward trajectory of house prices suggested by these headlines and expected in some parts of Canada is not, however, on the horizon in Alberta.

Average home prices in Vancouver and Toronto were already skyhigh going into the pandemic while other Canadian cities have experienced rapid price escalation since COVID became a household word.

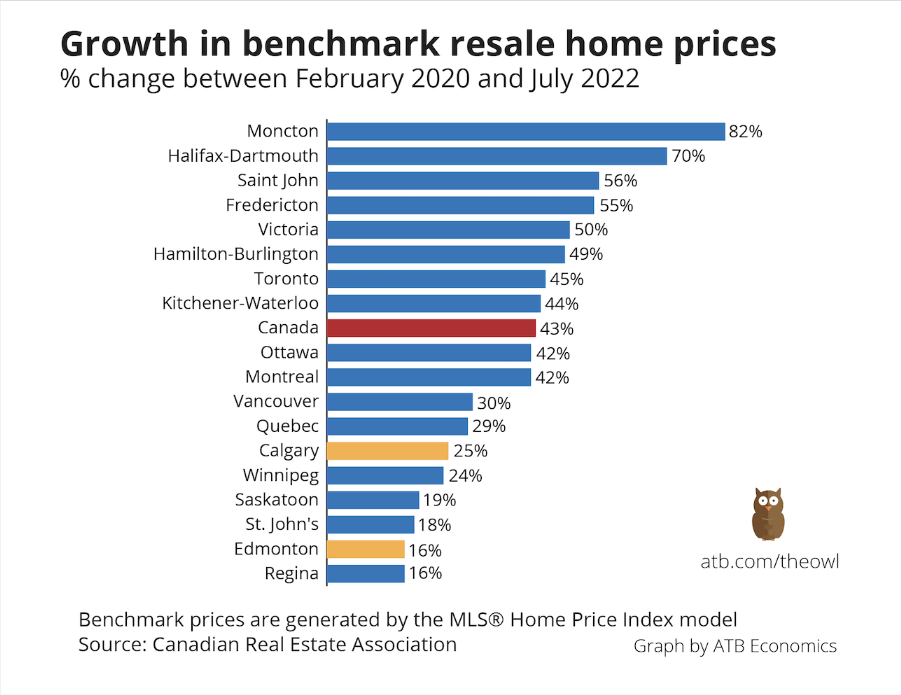

Take Moncton, New Brunswick: According to the Canadian Real Estate Association, the benchmark* price of a home on the resale market in the city jumped by 82% between February 2020 and July 2022. With the benchmark at $334,500, it was still a relatively affordable market (the benchmark in Toronto in July was, for example, $1,184,100), but buyers still had to come up with over $150,000 more for a typical home in the area than they did just two-and-a-half years ago.

While markets like Halifax-Dartmouth (+70%), Victoria (+50%) and Hamilton-Burlington (+49%) saw prices spike during the pandemic, Calgary and Edmonton posted solid, but more modest, growth at +25% and +16%, respectively. As such, because a housing bubble didn’t form here, there isn’t one to burst.

At the same time, robust economic growth in Alberta (we will likely lead the country in this regard in 2022), the recent return to being a net recipient of interprovincial migrants, a somewhat younger (though still aging) population, and the high quality of life offered here provide strong support for the provincial housing sector going forward.

As a recent report from Desjardins points out, “the oil-producing provinces of Alberta, Saskatchewan, and Newfoundland and Labrador [are] benefitting from post-pandemic tailwinds, largely in the form of higher commodity prices. The resulting job creation and workers it attracts from across the country will provide support to existing home sales and prices.”

Higher interest rates combined with national and global economic uncertainty may eat away somewhat at home prices in Alberta, but we should be able to avoid the potentially severe erosion that some other markets may experience.

*The MLS® Home Price Index (HPI) model is used to calculate benchmark prices in key Canadian markets. A “benchmark home” is one whose attributes are typical of homes traded in the area where it is located and includes single family homes, townhouse/row units and apartment units.

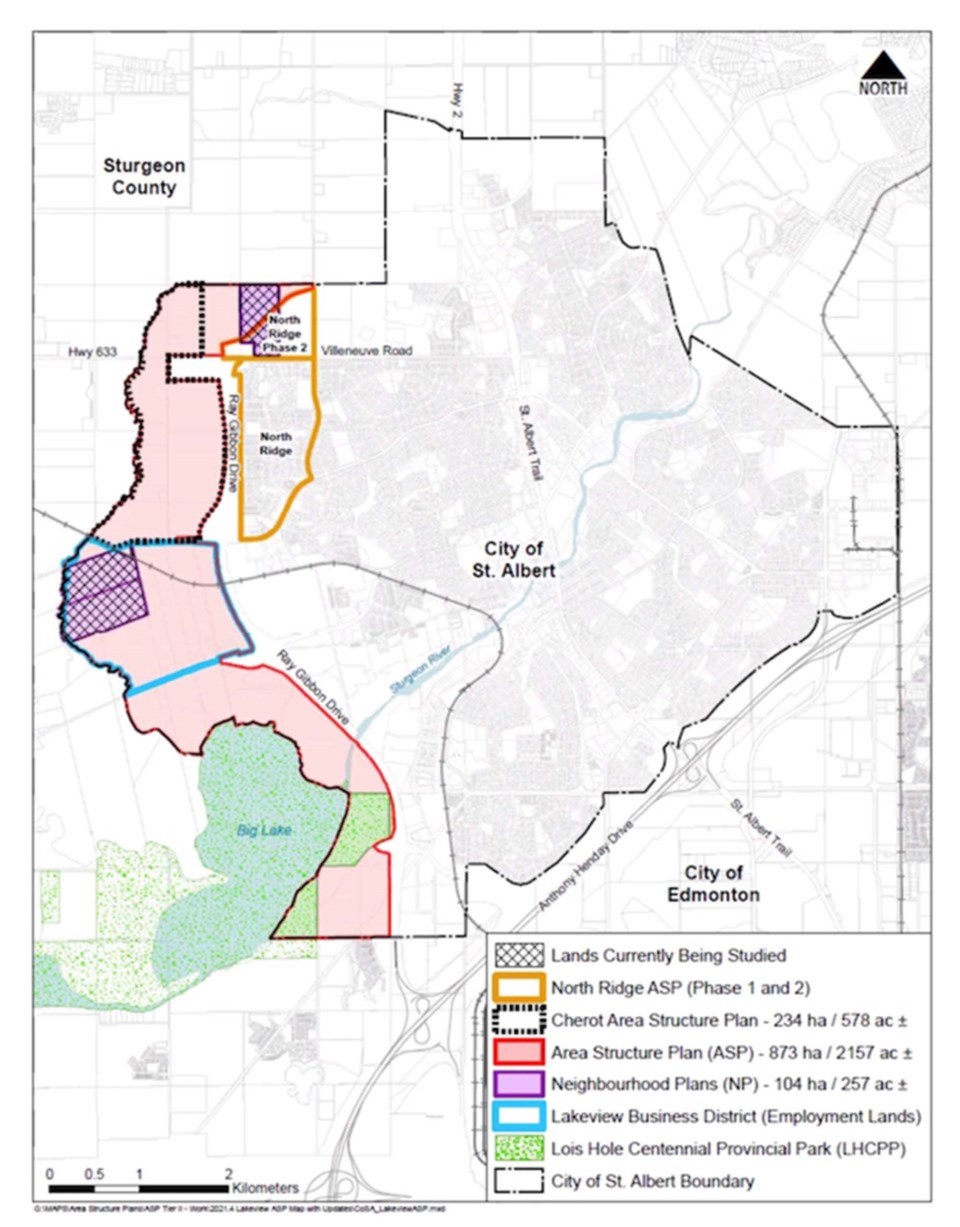

The City of St. Albert is working toward creating an area structure plan for the west end of the city, which will include the Lakeview Business District. The area will help expand the industrial space in St. Albert to allow for more businesses in the community.

The City of St. Albert is working toward creating an area structure plan for the west end of the city, which will include the Lakeview Business District. The area will help expand the industrial space in St. Albert to allow for more businesses in the community.