Relocation, relocation, relocation: Canadians love their neighbourhoods, but will move to achieve housing affordability

- For 64 per cent of Canadians, relocation is among the top sacrifice they’d be willing to make in order to achieve housing affordability; however, half (50 per cent) agree that the farthest they would go would be less than 100 kilometres

- 56 per cent say that moving to a different neighbourhood/community would be one of the top three sacrifices they would make

- 38 per cent would make the sacrifice of moving to a different city/province/region regardless of distance

- 38 per cent of Canadians define housing affordability as a home they can afford that meets their basic needs, and includes some liveability elements, such as green spaces and restaurants

- Based on average residential selling price, Brandon, MB ranked as the most affordable market in 2022, replacing Winnipeg which was most affordable in RE/MAX Canada’s 2021 ranking. This is followed by Regina, SK (which remained on the list year-over-year), St. John’s, NL, Moncton, NB and Red Deer, AB

- Based on the share of income spent on mortgage payments, Red Deer, AB ranked as Canada’s most affordable housing market, with 25.86% of average monthly income spent on the average-priced home. This is followed by Regina, SK (26.94%) and Brandon, MB (27.73%) in Western Canada. Eastern Canada’s most affordable regions to buy a carry a mortgage include Thunder Bay, ON (29.78% of monthly income spent on mortgage), followed by St. John’s, NL (31.45%) and Moncton, NB (33.4%)

Toronto, ON and Kelowna, BC (July 20, 2022) — RE/MAX® Canada’s 2022 Housing Affordability Report reveals that 68 per cent of Canadians are willing to make at least one sacrifice to buy a home they can afford, according to a Leger survey commissioned by RE/MAX Canada. The most common concession is relocation, as identified by 64 per cent of survey respondents – a trend that continues to reign as a primary influence in local housing markets across the country, say RE/MAX brokers. This is followed by 56 per cent indicating they would be willing to sacrifice the type of home they purchased; purchasing a home under co-ownership with family and friends, as identified by 29 per cent of survey respondents; and renting a part of their home for additional income, at 27 per cent.

According to the same Leger survey, 43 per cent of Canadians said the high price of real estate in their area was a barrier to entry into the market. This is up one per cent from last year. Other hurdles include a higher cost of living (35 per cent); a shortfall in salary (24 per cent, down two per cent from 2021); market volatility (24 per cent); and rising interest rates (24 per cent, up six per cent from 2021).

“Despite affordability challenges across the cost-of-living spectrum, Canadians are still eager to engage in the housing market – even if it means making some sacrifices in the short-term to achieve affordable home ownership,” says Christopher Alexander, President, RE/MAX Canada.

RE/MAX Canada asked Canadians to define what “housing affordability” means to them – 38 per cent of survey respondents defined affordable housing as “a home they can afford and meets their basic needs, and includes some of the liveability elements they like such as proximity to school; or walkable neighbourhoods,” to name a few.

“While we wait for governments to implement a national housing strategy to boost Canada’s supply of affordable housing, in the short-term the market is starting to cool and balance itself out, bringing some much-needed relief from the sky-high prices that we experienced during much of the pandemic. This trend is largely being driven by higher interest rates,” says Alexander.

Housing Affordability in Canada: Regional Market Trends

RE/MAX Canada brokers and agents in 24 key markets across the country were asked to provide their analysis on local market activity and housing affordability trends for the first half of 2022.

Housing Affordability in Western Canada

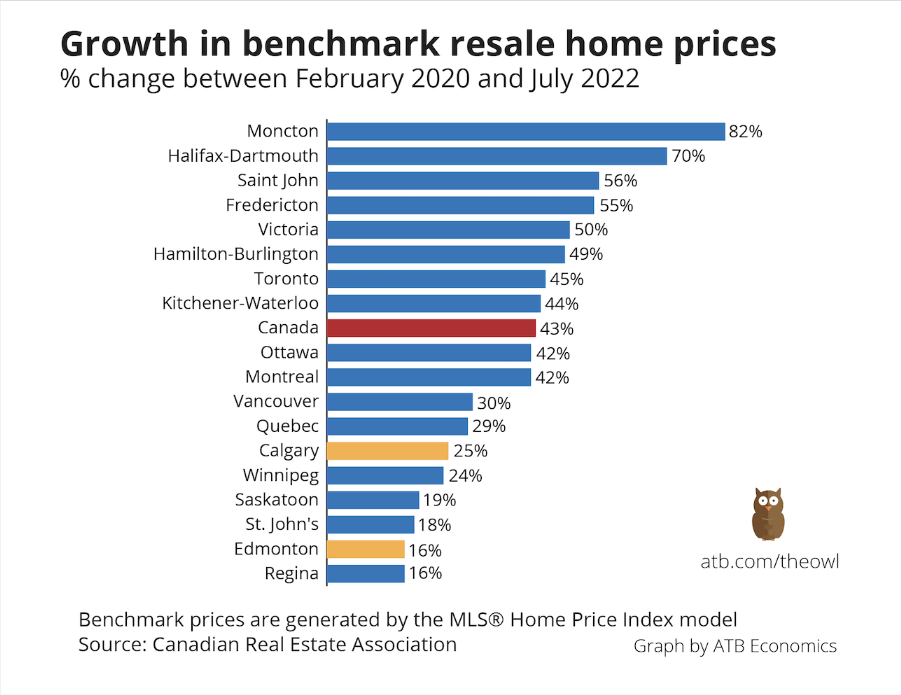

Across Western Canada, competition from out-of-town or move-over buyers has put upward pressure on home prices year-over-year. Double-digit year-over-year price increases were noted in Kelowna/Central Okanagan, BC (+21.1% from $778,657 in 2021 to $942,977 in 2022), Vancouver, BC (+19.69% from $1,097,000 in 2021 to $1,313,000 in 2022), Victoria, BC (+14.93% from $885,117 in 2021 to $1,017,292 in 2022), and Winnipeg, MB (+12.66% from $388,291 in 2021 to $437,460 in 2022). Meanwhile, more modest price increases were seen in markets including Calgary, AB (+5.85% from $499,229 in 2021 to $528,440 in 2022), Edmonton, AB (+4.73% from $390,490 in 2021 to $408,961 in 2022), Red Deer, AB (+3.24 % from $345,576 in 2021 to $356,779 in 2022), Regina, SK (+0.42% from $322,600 in 2021 to $323,950 in 2022), Brandon, MB (+1.75% from $304,929 in 2021 to $310,252 in 2022) and Saskatoon, SK (+1.45 from $368,079 in 2021 to $373,410 in 2022).

In regions such as Victoria, BC, and Vancouver, BC, some of the most significant factors impacting housing affordability include the high cost of living, inflation, and the housing supply shortage, which is being further compounded by new-home construction delays. Some of these factors reign true as well in regions such as Edmonton, AB, where affordability challenges are being attributed to residential construction delays; out-of-province/out-of-region buyers driving up demand and prices; and rising interest rates. In Calgary, the primary factor has been rising interest rates.

As buyers navigate high housing prices, some regions across Western Canada are experiencing trends such as properties being purchased as a primary residence while also renting part of the home to supplement monthly mortgage payments. The pooling of finances between friends and family has continued to remain a trend, as noted by the local RE/MAX broker in Victoria, BC.

The most affordable neighbourhoods across Western Canada regions surveyed include:

- Victoria, BC – Sooke, Saanich West and View Royal

- Kelowna/Central Okanagan, BC – Rutland, Glenrosa and Kelowna North

- Edmonton, AB – Beverly/Beacon Heights, Prince Rupert/Queen Mary Park and Westwood

- Calgary, AB – Dover, Erinwoods and Abbeydale

- Red Deer, AB – Vanier Woods, Sunnybrook South and Laredo

- Winnipeg, MB – Transcona, North Kildonan and Riverbend

- Brandon, MB – Souris, Wawanesa and Rivers

- Saskatoon, SK – Riversdale, King George and Casewell Hill

Interest Rate Effect on Housing Affordability in Canada

The record-low interest rates that first appeared in 2020 and continued throughout 2021 presented an exceptional opportunity for Canadians to enter or move up in the housing market. However, they also added fuel to an already hot market. With inflation at a 40-year high and interest rates rising, the housing market is starting to cool. In late 2021, RE/MAX Canada had anticipated steady price growth for the year ahead, with an estimated 9.2-per-cent increase in average residential sale prices across the country for 2022. Currently, with the exception of Hamilton, Ontario, price growth appears to be easing – a trend that is expected to continue through the remainder of 2022, with growth likely to occur in the single digits, and some markets expected to experience a modest decline.

“Despite current economic conditions, rising interest rates are not the biggest factor impacting housing affordability,” says Benjamin Tal, Deputy Chief Economist, CIBC. “Instead, it’s the pace at which interest rates increase that poses a greater risk to the housing market and economy in the short-term. In the long-run, factors such as rising immigration levels putting further strain on demand, limited housing supply, supply chain hold-ups, and the shortage of skilled labourers will be the greatest hurdles in overcoming Canada’s housing affordability crisis. These must all be addressed in order to help balance supply.”

Adds Elton Ash, Executive Vice President, RE/MAX Canada, “The shifts we are seeing in the housing market, with prices starting to ease across the country in tandem with softening demand and sales, are an overdue adjustment. A healthy housing market is characterized by price appreciation in the mid- to high-single digits, and many markets across Canada are re-entering that comfort zone.”

Based on broker insights and external data, as indicated within the accompanying RE/MAX Canada Housing Affordability Index, the average monthly mortgage amount across Canada ranges from approximately $1,492 to $6,314. Depending on regional income levels and with a 20-per-cent down payment, this accounts for anywhere from 25.86 to 112.25 per cent of Canadians’ monthly income. According to the Leger survey, 18 per cent of Canadians define housing affordability as allocating only 30 to 40 per cent of their monthly household income toward housing costs, including mortgage payments, property taxes and other housing-related expenses.

Thus, concern over the ability to afford a home remains among Canadians, with 68 per cent of survey respondents agree that they can’t afford to buy a home in the neighbourhood/region they choose in the next six months; 64 per cent say that eroding housing affordability is making them less confident in their ability to purchase a home; and 63 per cent express that rising interest rates are prompting them to put their home-buying plans on hold for the foreseeable future. Unsurprisingly, 70 per cent of Canadians agree that Canada needs a national housing strategy to solve the housing crisis. This number is up 10 per cent from last year.

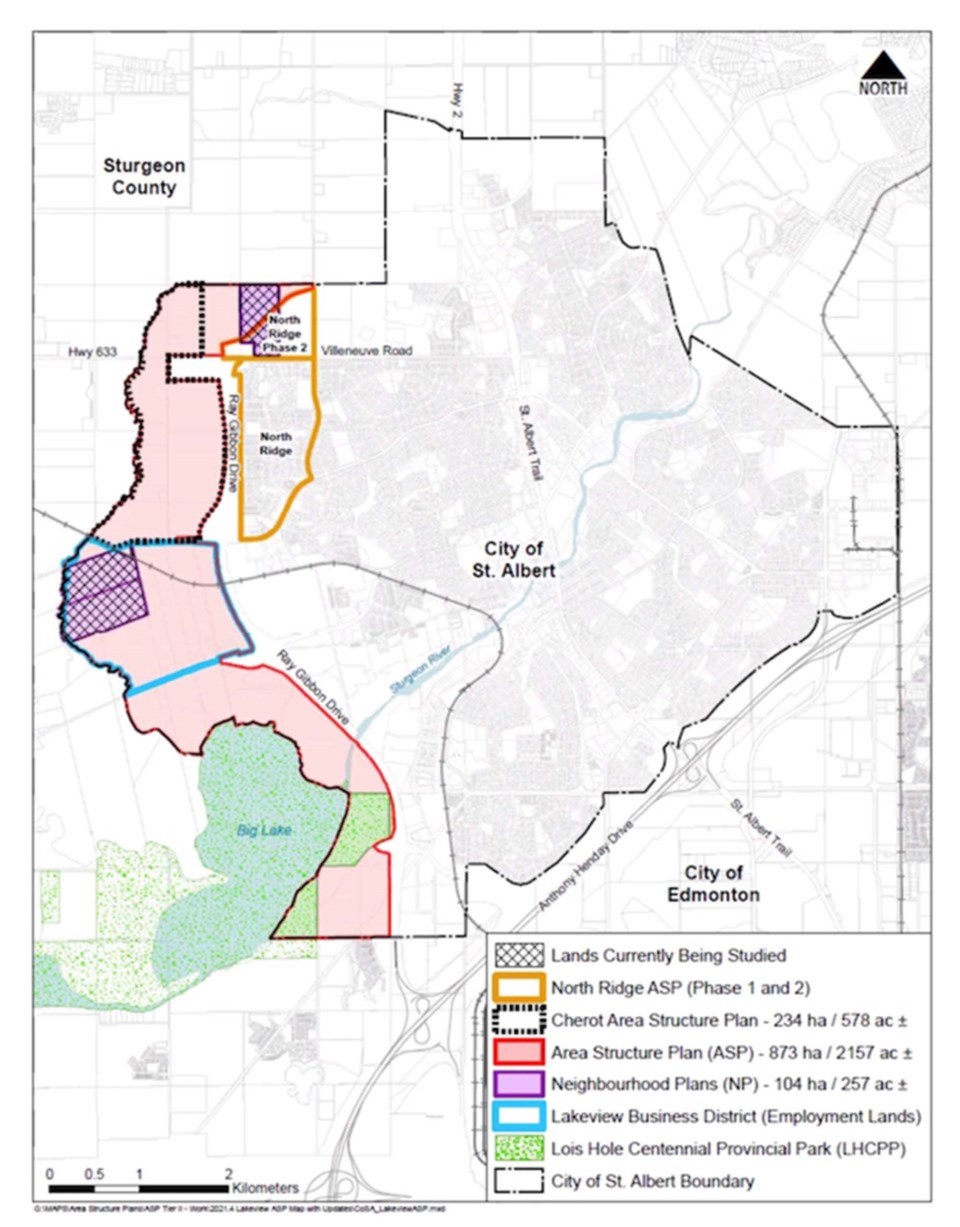

The City of St. Albert is working toward creating an area structure plan for the west end of the city, which will include the Lakeview Business District. The area will help expand the industrial space in St. Albert to allow for more businesses in the community.

The City of St. Albert is working toward creating an area structure plan for the west end of the city, which will include the Lakeview Business District. The area will help expand the industrial space in St. Albert to allow for more businesses in the community.