Tackling a home decorating project in 2021? These are the hottest paint colors this year.

Celebrate the spring of 2021 by giving your home interior a refreshing colour update. Nothing says new year, new you like a splash of colour on an accent wall. Or maybe you’re looking at warm, earthy neutrals throughout to bring grounding to your life and space. Whatever your reasons, whatever the room to redecorate, this year’s colour trends are ready to help you say goodbye to 2020 and embrace a hopeful and happy year ahead.

Take a look at this list of the hottest home paint colours of 2021 according to trusted home-style guides like Better Homes & Gardens and Good Housekeeping and the official Colours of the Year by paint colour kings like Behr and Benjamin Moore:

Walls

It’s unanimous–2021 is about warmer whites and grounding, earth-tone neutrals contrasted with bold, dare we say audacious, hues. Which do you feel best represents and inspires you in your space? We’ve highlighted this year’s colours of the year by category below, neutral and vibrant.

If you’re looking for a calm, inviting base to use absolutely anywhere, check out these trending neutrals:

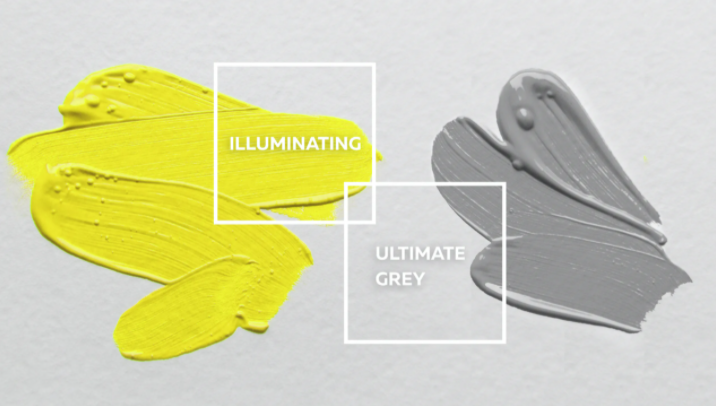

Ultimate Gray

Named one of the two colours of the year, Pantone calls Ultimate Gray a “dependable” colour. And certainly, this versatile colour works in any home setting, especially in rooms where you want to evoke a sense of strength and solidity. (Pantone’s second colour of 2021 was “Illuminating,” a warm, happy yellow that pairs nicely with Ultimate.)

Urbane Bronze

Sherwin-Williams chose this nature-inspired colour as their 2021 colour of the year. Its deep bronze warmth creates a soothing, earthy backdrop designed to bring you back to nature and highlight other organic elements in your interior design.

If big colour is what you’re after, check out these vibrant hues:

Aegean Teal

This blue-green paint, named colour of the year by Benjamin Moore, is calm but bold. Both its name and its hue bring to mind the waters and the spirit of the Mediterranean.

Passionate

As part of HGTV Home by Sherwin-Williams’s “Delightfully Daring” colour collection, Passionate plays its part in bringing boldness to your space. This rich, warm red is perfect for those spaces where you want to bring your passion.

Behr’s Color Trend Palette

This is a selection of 21 colours, including earthy and comforting browns and yellows accented with adventurous colours like “Euphoric Magenta” and “Saffron Strands.” Keywords to convey the spirit of this collection include “warm,” “restorative,” and “evocative.” So whatever balance you want your 2021 to strike, they’ve got a colour to help you achieve it.

Accent Walls & Accessories (furniture and more)

As you know, paint isn’t only for walls. Refinishing a dresser or table with a bright coat of paint can create an inspiring statement piece and quickly rejuvenate a stale or tired atmosphere. Try these trending colours to bring some spice and daring to your space.

Satin Paprika

This red by Rust-Oleum, the spray paint giant, is another warm earth tone, but with just the right depth to add modern zest to your home accessories.

Aqua Fiesta by Glidden and PPG’s Misty Aqua

These aquas are joining 2021’s sea-inspired blue-greens. Bring some of your beach-vacation anticipation to your home with these bright, happy aquas that simultaneously evoke energy and calm.

This year’s trending paint colours seem to reflect a collective desire for grounding, reconnecting, and asserting our strengths. They add warmth and stability with inviting neutrals, and they inspire and impassion with vibrant, dramatic hues.

Whatever your project, a couple of cans of this year’s trending colours will reinvigorate your home’s ambiance and give you the boost you want when walking into your favourite rooms!